Bank Rules are a great Xero feature which help you automate the bank reconciliation process, saving you time and ensuring regular transactions are coded consistently. Using Bank Rules, Xero matches transactions to criteria you have set such as payee name and will apply (but not reconcile) codes, tax treatment and tracking according to the pre-set rule. Matched transactions appear in the bank reconciliation screen as shown below, and all you have to do is click “OK” for the transaction to be reconciled.

Transactions which are regular, have a common identifier such as payee name and do not need to be entered as an invoice are ideal for setting up with Bank Rules.

How do I set up Bank Rules?

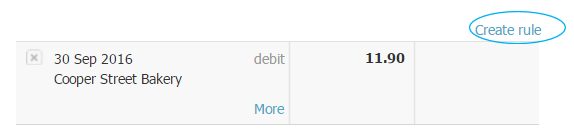

One of the easiest ways to create a Bank Rule is to go to your bank reconciliation screen, find a transaction you wish to create a rule for and click “Create rule”.

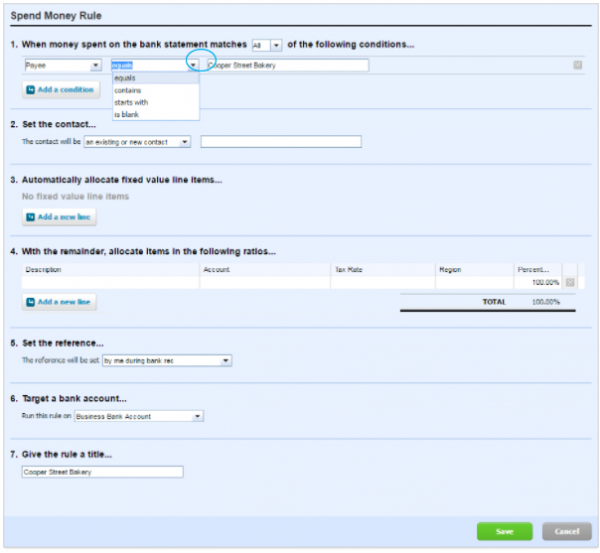

Now set up the conditions for your rule. Click on the drop down arrows as circled below to choose different criteria on which to set conditions.

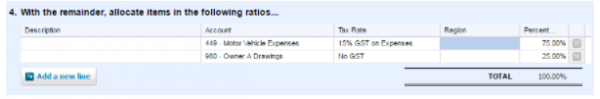

If your rule needs to split transactions between multiple codes on a percentage basis, for example, vehicle expenses are 75% business, 25% private, select “Add a new line” under point 4 and type in the percentage to apply to each code.

If you need to apply the same rule to multiple payees, select “Add a condition” under point 1 for each payee rather than setting up a rule for every payee.

Note that you are able to edit or remove and redo transactions once they have been reconciled using a Bank Rule.

To find out more about Bank Rules, check out this video or contact your WK Advisor.