As we have mentioned in recent articles, there are some relatively significant tax changes taking effect 1 April 2024 even though the draft legislation had not been released. Well finally, the detail behind upcoming changes was released yesterday when Amendment Paper 20 was finally publicly released. This Amendment Paper amends the Taxation (Annual Rates for 2023-24, Multinational Tax, and Remedial Matters) Bill which is expected to be passed by Parliament on or about the 28th of March 2024.

As expected, the Amendment Paper includes the following well signalled changes:

- The phase back of interest deductions on residential rental properties

- The roll-back of bright-line to two years

- Removal of depreciation on commercial buildings.

The amendment paper also includes some changes that were not as well signalled:

- A tax on overseas gambling duty (signalled prior to the election, but not mentioned much since)

- Relaxation of the situations where trading stock is deemed to be sold at market value.

Most of the changes are as anticipated, but there are a few pleasant surprises. We discuss these changes (except for the online gambling duty) below.

Interest deductibility

The removal of interest deductions by the last Government was an embarrassment of a policy that goes against all of the fundamental principles of New Zealand tax policy. Further, this policy only added upwards pressure to rents because there is already a shortage of rental properties across much of the country and, therefore, supply and demand gave landlords the opportunity to pass some of their additional costs onto tenants. Further, the incentive for new investment into rental properties was diminished thereby worsening the shortage of rental properties. Therefore, from both a tax policy, and a cost-of-living perspective we welcome the eventual removal of the interest denial rules.

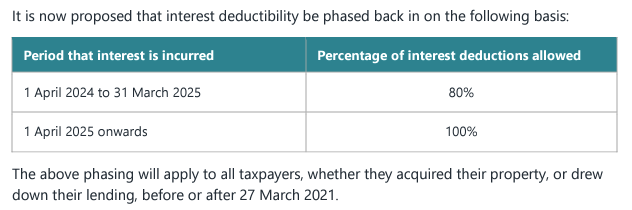

As previously signalled, interest deductions will be phased back in, and the phase-in will work as follows:

We had anticipated that the phase in would apply to all properties and welcome the fact that this is what is being adopted. Therefore, all rental properties will have at least 80% deductibility for the 2024/25 year. Anyone who was previously exempt from the interest denial rules and still had 100% deductibility (new builds, social housing etc) will retain 100% deductibility.

Return of the two-year bright-line test

The original two year bright-line test was first introduced by the then National-led Government in 2015, it was designed to be a crude measure to target property speculation or flipping. The Labour-led Government then cynically extended it to five and then ten years whilst still claiming it was aimed at preventing property speculation. The five- and ten-year periods have largely been a disaster that has quite predictably distorted the property market reducing supply by locking in owners and therefore increasing upward pressure on prices. These rules have also caught out many non-speculators for changes in personal circumstances or helping their children get on the property ladder etc. Therefore, we welcome the return to a rule that is fit for purpose.

Addressing the policy failings of the five and ten years is one thing, however, addressing the additional compliance created by the complexity that the five- and ten-year rules might be the bigger win from our perspective as we have had to navigate through a minefield of very fact specific date-driven rules over the past few years.

As previously signalled, the rule is changing back to two-years for bright-line periods ending on or after 1 July 2024 in all cases. In 99% of situations this will be when the owner signs an agreement to sell. In other words, there will only be one set of bright-line rules come 1 July 2024

All exemptions will generally be restored to the original 2015 policy settings. However, one positive change is that the main home exemption will ignore periods of construction in determining whether the property was used as a main home for the majority of the bright-line period. The carve-out was recently added for the 5-year main-home exemption but was not a feature of the original main-home exemption.

One surprise is that the “roll-over relief rules” are being extended and simplified to provide roll-over relief to all associated persons transfers. Although, there is an anti-avoidance test added to stop this being abused by only allowing roll-over relief once in a two-year period. We welcome this as a major improvement over the current roll-over relief rules that are unnecessarily complex.

Return of depreciation on commercial buildings

Back in 2010, the National-led government removed depreciation on all buildings. In 2020, the Labour-led Government reintroduced depreciation on commercial buildings under the guises of a Covid relief measure (although it was actually a recommendation from the Inland Revenue about 6 months before Covid). I must say the removal of depreciation here is a bit of a head-scratcher given that Inland Revenue had previously advised Government that commercial buildings should be depreciated because they tend to economically depreciate over a period of say around years. The removal of depreciation here seems to be entirely fiscally driven as the Government seeks to balance the books and this raises the question as to whether it will be a temporary change.

Given that building fit out remains depreciable, and that building structure depreciation is often recovered on the eventual sale of buildings, this change is not overly significant in the scheme of things, but it will impact cashflow of commercial property owners.

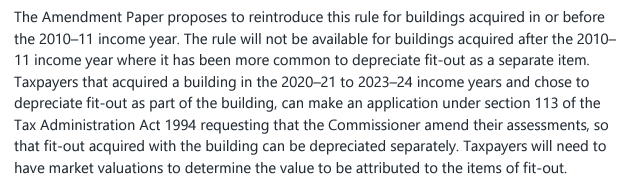

The first-time depreciation was removed 2010 a concession was introduced to allow commercial building owners who had not identified and split their building fitout to split out 15% of the building value a notional amount of fitout and depreciate that at 2%. For commercial property owners who purchased their building in or before the 2010-11 year, this 15% pool is being re-introduced, but the depreciation rate will be reduced to 1.5% straight-line (it was 25 SL last time). No such concession applies for owners who purchased their buildings after the 2010-11 year as they will have split their fit-out from their buildings in line with the rules applying at the time.

Another surprise in the Amendment Paper is the following, which will allow building owners who have purchased buildings since the reintroduction of depreciation on buildings in 2020 to effectively restate their fixed asset schedules if they had not split out their fit-out as discussed below:

We note that back in 2010/11 attempts to retrospectively restate fitout were denied by Inland Revenue as being a “regretted choice”, so it is good to see that recent purchases will now be able to be “corrected”. We don’t expect that this will be too common as the practice of diligently splitting out fit-out has generally remained since depreciation was reinstated on commercial buildings.

Disposals of trading stock

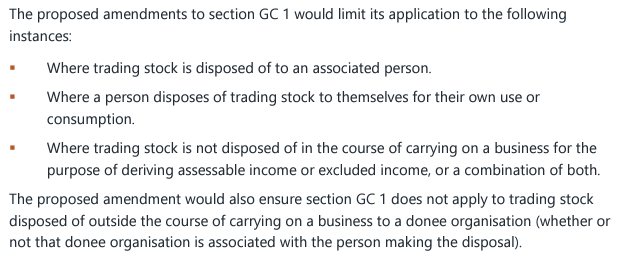

There is a long-standing anti-avoidance rule that applies where a person or business disposes of its trading stock. Under the current rules, the person or business is deemed to have disposed of the trading stock at market value irrespective of the circumstances. Although, there have been some slight modifications to that rule through case law such as the fact that market value is determined in the context of the transaction (such as a “fire sale” by a business in distress, or the stock is included in the sale of the whole business as a going concern). This broad anti-avoidance test has historically caused some over-taxation issues.

In recent years, there has been plenty of talk about relaxing this rule to stop it applying to disposals of stocks to charities or for disaster relief etc, and from time-to-time temporary measures have been enacted to allow this.

Now the anti-avoidance test is being narrowed as described below so that it more targeted towards transactions that have an avoidance risk.

These proposals will apply from 1 April 2024, although it should be noted that they largely replace a Covid relief measure that expires 31 March 2024.